Growing, but still in control

The Dutch financing market has changed considerably in recent years. The banks are back after a number of years, but the days when the house bank was the only external source of financing for the business are long gone. This does not make things any easier for the entrepreneur. The challenge nowadays is to organise the right financing at the right conditions, which best suits the company.

No surrender of shares or securities, but cash flow

In the event of rapid growth or an acquisition, the lack of collateral can be an obstacle to obtaining financing from the bank. Especially if this is combined with a (too) low solvency. Previously, the company had to rely on strengthening its equity capital. This is not always the most desirable option when you are growing rapidly as an entrepreneur and expect the value of the company to increase significantly in the coming years. Of course there are schemes from the government that can offer bank guarantees, but these schemes also have their limits and specific disadvantages.

Don't be blinded by rate

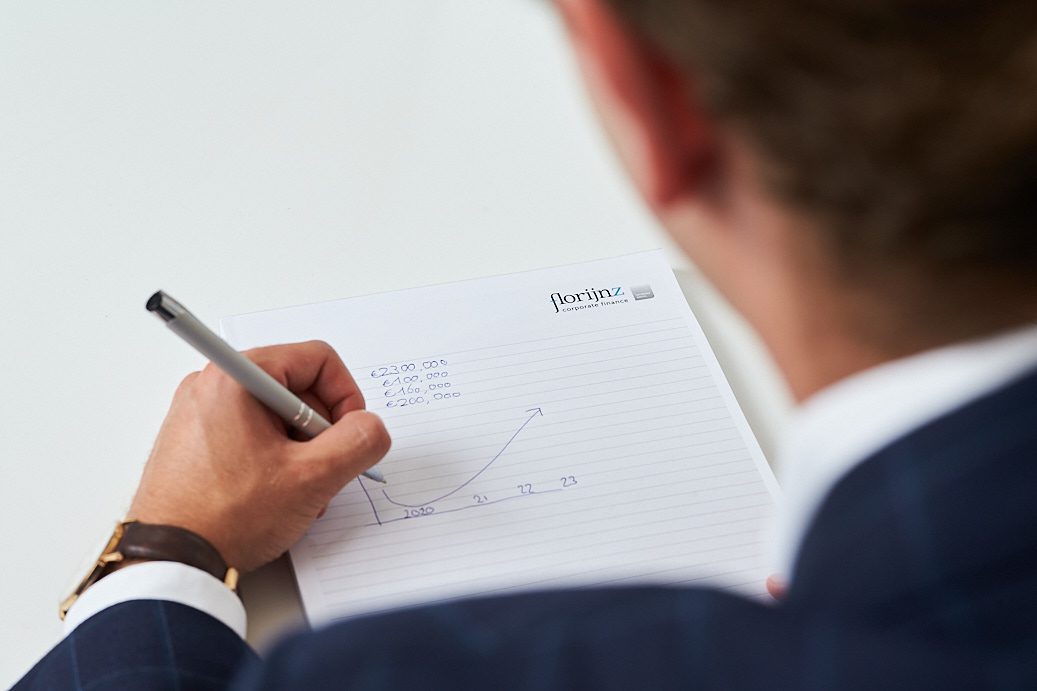

There are various parties who can offer a good solution, especially in the growth phase, or at the time of an acquisition. Good entrepreneurship, market potential and cash flow are the main criteria for providing financing. Depending on the financier, the loan can be subordinated, a grace period can be agreed and the interest can be rolled up. All this fits the cash flow of the company. The interest rate of such financing is significantly higher than a regular bank loan. However, in a period of strong growth of the value of the company, this disadvantage can more than compensate for attracting equity capital.

Want to know more?